AI-Driven Financial Planning: Smarter Money Decisions, Human Goals

Chosen theme: AI-Driven Financial Planning. Welcome to a space where algorithms amplify clarity and you stay in control. We’ll turn messy money moments into clear steps, blending data-driven insights with your real-life dreams. Subscribe to follow the journey and shape it with your questions.

What AI-Driven Financial Planning Really Means

AI ingests transaction histories, income patterns, and savings trends, then highlights opportunities you might miss. It won’t predict the future perfectly, but it can rank options, quantify trade-offs, and suggest adjustments that align with your risk tolerance and priorities.

What AI-Driven Financial Planning Really Means

You describe the life you want—security, freedom, meaningful spending—and the system translates those ambitions into parameters. With constraints set thoughtfully, recommendations stay personal, measurable, and adaptive as your situation evolves and better data refines the plan.

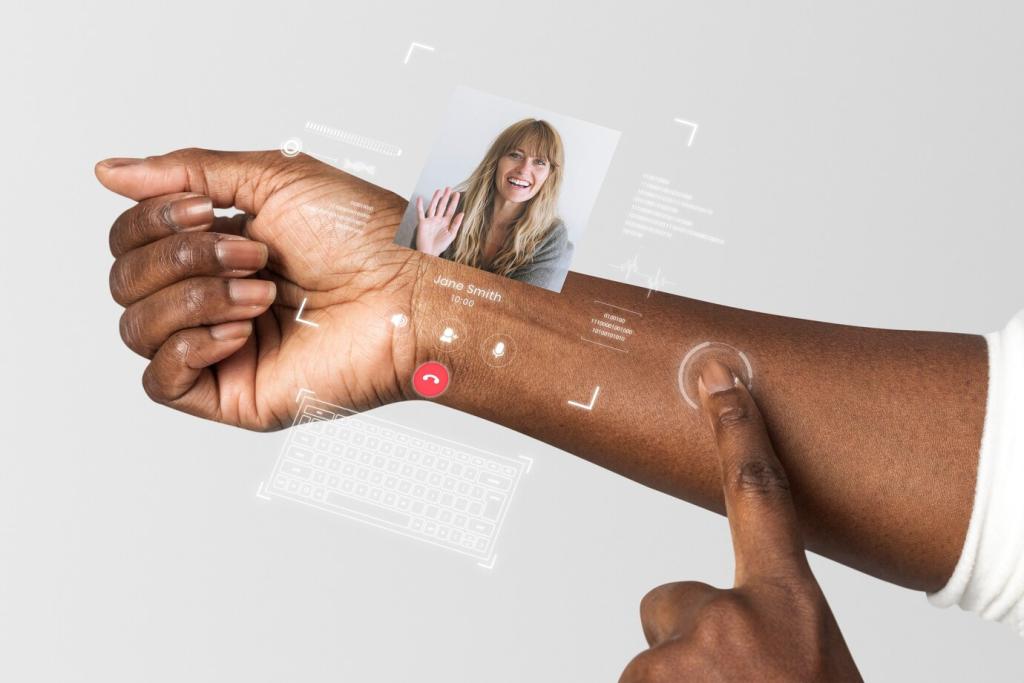

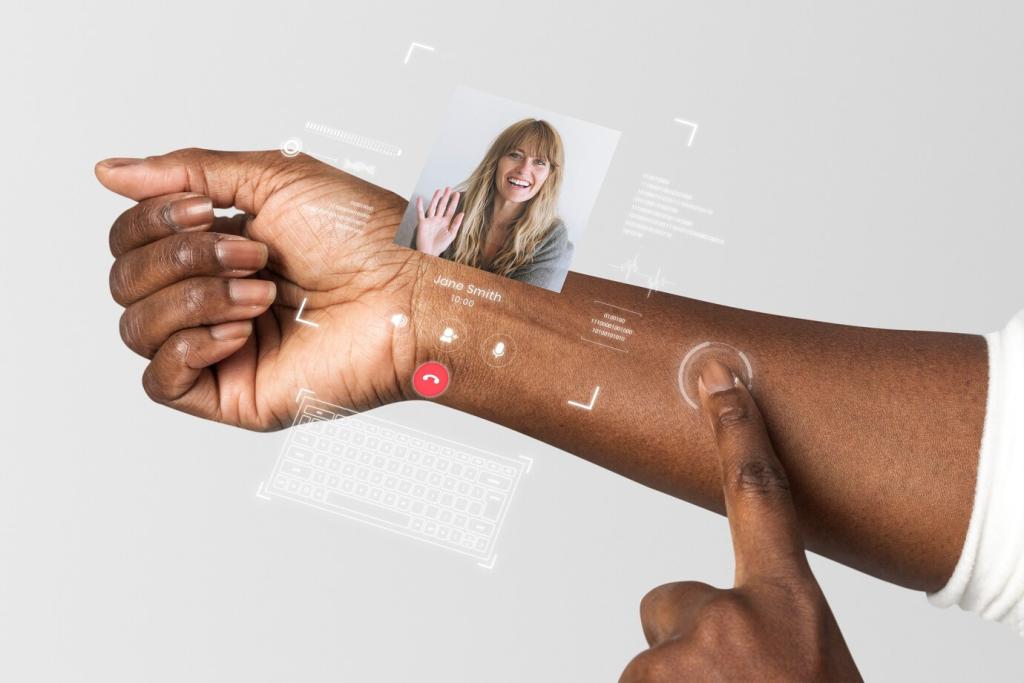

Budgeting with Algorithms: Everyday Cash Flow That Learns

Systems spot seasonal spikes, weekend splurges, and forgotten renewals. Instead of shame, you get options: small category caps, merchant-specific alerts, or automatic transfers that smooth month-end stress. Comment with a category you want the assistant to analyze first.

Budgeting with Algorithms: Everyday Cash Flow That Learns

Digital envelopes update in real time. When groceries run hot, dining out cools automatically. Alerts arrive before thresholds break, not after. You remain the pilot; the algorithm provides weather reports, turbulence warnings, and updated routes for calmer financial travel.

Investing with AI: Risk, Return, and Realism

Expect distributions, not guarantees. Tools run Monte Carlo simulations and stress tests to show how portfolios might behave. You explore trade-offs across volatility, drawdowns, and goals. Ask for a scenario you want us to model in a future post.

Tell the system your non-negotiables—diversification, fees, values screens—and it searches thousands of combinations that satisfy them. Rebalance suggestions appear when drift exceeds your thresholds. You approve changes, preserving transparency, intent, and long-term discipline.

During a sudden market drop, Alex’s plan didn’t panic. The assistant rechecked risk budgets, paused discretionary buys, and proposed a tax-loss harvest. Alex clicked confirm once, then went hiking. Comment if you want a walkthrough of that exact workflow.

Life Events Planning: When Everything Changes, Your Plan Adapts

Feed the assistant local prices, interest rates, and your monthly comfort zone. It estimates closing costs, reserves for maintenance, and stress-tests payments against job changes. Share your city and we’ll feature a community mortgage affordability snapshot.

Life Events Planning: When Everything Changes, Your Plan Adapts

Set timelines and contribution amounts; the system projects growth, adjusts for inflation, and flags scholarship windows. It even surfaces trade-offs between 529 contributions and other goals. Tell us your target start year to receive a personalized planning checklist.

Privacy, Ethics, and Control in AI Financial Tools

Connect only what’s required, prefer read-only access, and enable multi-factor authentication. Look for encryption in transit and at rest, audit logs, and clear data deletion policies. Comment with tools you trust, and we’ll compile a community-reviewed shortlist.

Privacy, Ethics, and Control in AI Financial Tools

Ask why a recommendation appears. Good systems show inputs, constraints, and confidence ranges, not just outcomes. If a result feels off, you can adjust assumptions and retest, making the process collaborative rather than mysterious.

Choosing an AI Planning Stack

Begin with a trustworthy aggregator, an automated budgeting app, and a transparent investment assistant. Prioritize open data standards, export options, and human support. Tell us which platform you’re considering, and we’ll share a setup guide tailored to beginners.

Weekly Rituals That Compound

Hold a fifteen-minute money check-in: categorize edge-case transactions, review alerts, and approve suggestions. Small, consistent actions beat marathon sessions. Post your ritual in the comments to inspire others and keep yourself accountable.

Join the Conversation and Subscribe

Ask for a walkthrough, vote on upcoming topics, or submit a tough scenario for analysis. Subscribe now to receive templates, experiments, and community Q&A focused entirely on AI-driven financial planning that puts your goals first.