Today’s Theme: Risk Assessment in Personal Finance with AI

Step into a smarter, calmer money life. Our focus today is Risk Assessment in Personal Finance with AI—practical tools, relatable stories, and clear steps to help you understand uncertainty, anticipate shocks, and make confident choices. Subscribe and join the conversation.

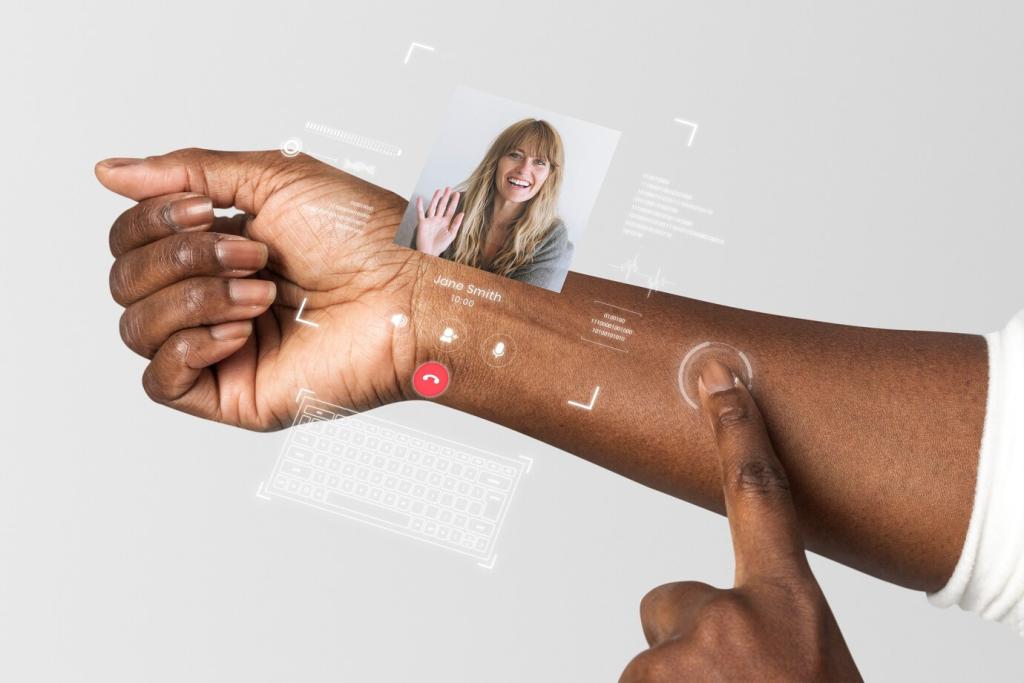

Why AI Changes How We See Personal Financial Risk

Imagine waking up to a simple, friendly briefing: this week’s biggest risk is cash-flow squeeze from upcoming bills and a variable-rate loan. AI spots patterns your eyes miss, turning hidden volatility into upfront awareness. Comment with your top worry to receive tailored insights.

Why AI Changes How We See Personal Financial Risk

Traditional advice offers static ratios; AI adapts thresholds to your income stability, expense unpredictability, and goals. It recalibrates as your life changes—new job, baby on the way, side hustle growth. Share your latest life change so we can discuss adaptive risk targets.

Mapping Your Personal Risk Landscape with Data

AI quantifies how predictable your paychecks are and how chaotic your spending becomes near month-end. High volatility and entropy mean larger buffers are prudent. Curious about your entropy score? Drop a note with your budgeting approach, and we’ll suggest a starter metric.

Mapping Your Personal Risk Landscape with Data

Models weigh card utilization, teaser-rate expiries, and variable-rate exposure. Even a small rate hike can shift minimum payments and cash flow risk. Want a quick sensitivity snapshot? Tell us your top debt type, and we’ll share a practical, AI-informed checklist.

Models That Matter: From Trees to Transformers

Logistic regression and decision trees provide interpretable starting points. Techniques like SHAP reveal which features—rent spikes, subscription creep, utilization surges—drive your risk score. Want to learn SHAP basics for your budget? Subscribe for our plain-language explainer series.

Models That Matter: From Trees to Transformers

Transformers and recurrent nets capture seasonality, pay cycles, and anomalies in transaction sequences. They flag drifts early—before overdrafts or missed payments. Tell us about your most unpredictable expense, and we’ll share a simple anomaly checklist to tame it.

Models That Matter: From Trees to Transformers

A good model isn’t just accurate; it’s calibrated. Backtests compare predicted shortfall probabilities to actual outcomes. That alignment builds trust. Curious how your plan would have fared last year? Comment “backtest,” and we’ll outline a do-it-yourself routine.

Life shocks and ‘what if’ drills

Model a pay cut, a medical bill, or childcare cost jump. AI shows timeline impacts, buffer erosion, and best mitigation levers. Run one drill this week and share your top surprise in the comments—your insight could help someone else prepare.

Portfolio risk under everyday uncertainty

Monte Carlo simulations translate market noise into potential portfolio paths and drawdowns. See how savings rate, rebalancing rules, and fees alter downside risk. Want a one-page simulation primer? Subscribe, and we’ll send a friendly, no-jargon walkthrough.

Debt and cash-flow stress in rising-rate worlds

AI estimates how rate increases ripple through variable loans, credit cards, and refinancing timelines. You’ll see thresholds where actions become urgent. Share your largest rate exposure, and we’ll suggest two measurable guardrails to monitor monthly.

Behavior, Bias, and AI Nudges that Stick

Models detect payday splurges and optimistic income forecasts that never materialize. Gentle nudges shift timing and amounts, preserving your safety margin. Which habit trips you up most? Comment below, and we’ll recommend a tailored, bias-aware adjustment you can try this week.

Behavior, Bias, and AI Nudges that Stick

A note saying “72% chance of regret if you skip the emergency fund this month” is more compelling than a ratio. AI translates math into relatable narratives. Want monthly narrative prompts? Subscribe for our behavior-focused risk briefings.

Ethics, Privacy, and Human Oversight

Collect only what’s necessary, encrypt at rest and in transit, and prefer on-device or federated learning when possible. Ask vendors how they delete data. Want a privacy checklist for finance apps? Comment “privacy,” and we’ll send our reader-tested guide.

Demand models tested for disparate impact and explainability. Periodically audit recommendations across demographics and life situations. If something feels off, pause and review. Share your fairness questions, and we’ll unpack them in a future community Q&A.

AI elevates awareness; you decide trade-offs. Document your risk preferences, thresholds, and exceptions. Revisit quarterly as life evolves. Want a template for a personal risk policy? Subscribe, and we’ll send a simple worksheet to guide your next review.