The Role of AI in Credit Score Management

Chosen theme: The Role of AI in Credit Score Management. Explore how intelligent models transform scoring from static numbers into dynamic guidance, helping you understand drivers, act earlier, and build healthier credit habits. Join the conversation and subscribe for fresh, practical insights.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

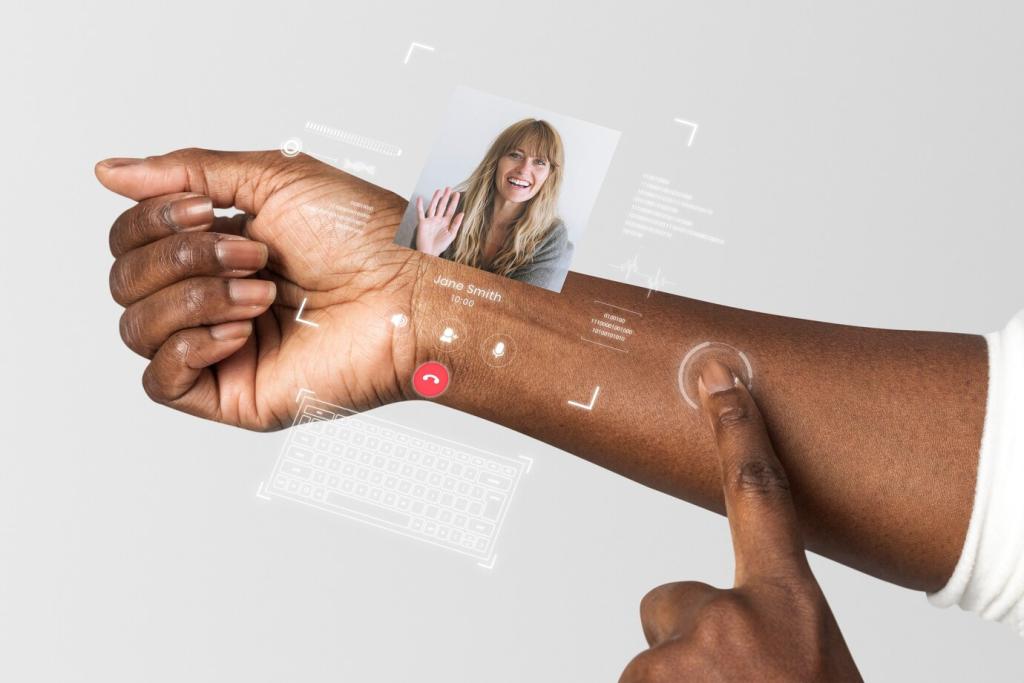

Real-Time Monitoring and Early Warnings

Anomalies in Spending Behavior

Unusual spikes in discretionary categories or sudden subscription growth can signal budget strain. Anomaly detectors flag patterns, suggest small adjustments, and encourage users to check in—comment with your favorite budget tricks so others can learn from you.

Utilization Spike Alerts

Short-lived utilization surges can be softened before statements close. AI estimates statement dates, recommends strategic payments, and shows projected score impact ranges, turning a stressful surprise into a deliberate, manageable plan you can implement today.

Proactive Payment Suggestions

Models learn your billing cadence to propose earlier payments, align due dates, and reduce late risk. Subscribing unlocks reminder personalization and community tips, helping you stay steady through busy weeks and unpredictable travel schedules without scrambling at the last minute.

Explainability That Builds Trust

Global and Local Explanations

Global feature rankings summarize systemwide drivers, while local explanations show why your score moved today. Techniques like SHAP contextualize factors in plain language, transforming opaque outputs into relatable insights tied to your habits and current financial season.

Human-in-the-Loop Oversight

Credit decisions often combine AI insights with analyst review. Human oversight challenges anomalies, validates context, and maintains accountability. Share your thoughts on where human judgment helps most—edge cases, life events, or rapidly changing economic conditions.

Clear Consumer Reports

Digestible reason codes, score trajectories, and what-if simulations empower you to test scenarios safely. Try exploring how early payments or reduced utilization might shape outcomes, then subscribe for deeper walkthroughs and upcoming reader Q&A sessions.

Privacy, Security, and Model Governance

Privacy-Preserving Learning

Techniques like federated learning and differential privacy can reduce exposure of sensitive information while still enabling useful patterns. When models learn from aggregates instead of raw records, your personal data stays better shielded against unnecessary risk.

Auditability and Version Control

Traceable model versions, documented training data windows, and controlled approvals make decisions reproducible. Governance committees review changes, while monitoring dashboards catch drift, ensuring your experience improves without unexpected shifts or unexplained score volatility.

Secure Data Pipelines

Encryption, least-privilege access, and automated checks protect information end-to-end. Incident response runbooks and tabletop drills prepare teams for contingencies, reinforcing trust that sensitive credit information is handled thoughtfully at every processing step.

Goal Setting and Micro-Actions

Set a target utilization range, pick a payment cadence, and commit to a small weekly step. AI tracks progress, celebrates milestones, and offers reminders. Tell us your goals, and we’ll feature community success stories in future posts.

Timing Nudges Around Billing Cycles

Well-timed suggestions can reduce reported balances significantly. AI maps issuer statement dates, forecasts balances, and proposes optimal payment windows. Subscribe to receive personalized timing tips based on your recent trends and upcoming cycle estimates.

Community Q&A and Feedback Loop

Your questions fuel better coaching. Share what confuses you about utilization, limits, or inquiries, and we’ll refine our guides. Comment below and help shape the next playbook for smarter, AI-informed credit moves.

Detecting Drift and Recalibration

Economic shifts alter relationships between variables. Drift detection triggers retraining or recalibration, preventing outdated assumptions from steering decisions. We’ll explain updates transparently so you always know why guidance or thresholds evolved.

Scenario Testing and Stress Models

Teams pressure-test models against hypothetical shocks like rate hikes or income interruptions. These simulations shape safer policies and better alerts, helping you prepare practical buffers rather than reacting after a score drop happens.

Communication During Volatility

Clear, timely messaging matters most in uncertainty. Expect simplified explanations, prioritized action steps, and resources tailored to your situation. Subscribe for alerts and contribute your experiences so we can highlight real-world strategies that work.